Unpacking the Future: An Exploration of Pet Food Labels

What’s Popular In Pet Labels

In the CPG industry, a product label can mean the success or failure of a product. Today’s packaging and ingredients need to meet pet parent expectations, so in this blog, we explore what messaging is making its way onto pet product labels.

Unpacking the Future: An Exploration of Pet Food Labels

There’s no arguing that the average consumer is more educated on pet nutrition than ever before. In fact, recent surveys show that more the 53% of pet owners are looking for healthy ingredients in pet food1, and a whopping 63% of dog owners are actively seeking products with branded ingredients2.

Compounding this growing health focus among consumers is a clear desire for sustainable packaging solutions. When surveyed on their green activities, 53% of pet owners were actively trying to reduce their use of plastics and 42% reported a desire for sustainable packaging1.

This awareness of ingredients and sustainable packaging means that, for pet food, presentation is more important than ever. To dive deeper into these evolving consumer trends, the experts at ADM set out to round up and evaluate the latest claims being made on pet food packaging.

Consistent growth in health claims

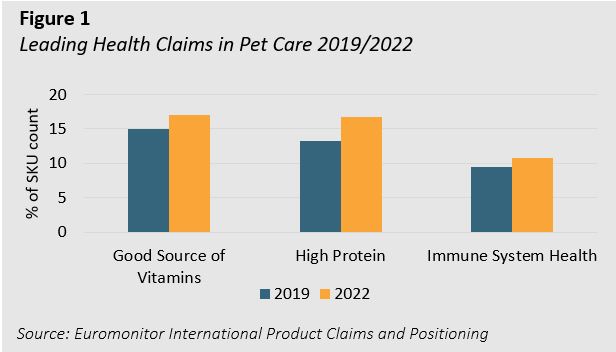

The top three health claims made on packaging (Figure 1) not only remained on top from 2019 through 2022, but they also grew in prevalence across SKUs. This tells us that pet brands are seeing consistent growth in health-oriented products.

Humanization is the likely driver in this health claim growth as consumers continue to familiarize themselves with the benefits of healthy eating in their own diets. Various human foods promote their protein content on packaging, and grocery stores are dedicating shelf space to all-natural and healthy products.

It’s easy to speculate that increased interest in healthy trends for humans has translated to on-package nutritional claims in pet food. Given the longstanding prevalence of these human trends, we expect this growth in nutritional claims to continue long into the future.

Alternative proteins are shaking up the industry

When it comes to specific ingredients, alternative proteins continue to expand both in humans and in pet food. Plant-based and cultivated proteins have been scientifically explored in human food over the past few years and created a growing market for these types of ingredients. Pet brands often promote sustainable ingredient sourcing or manufacturing practices on the packaging of these types of products1,3, potentially striking a chord with environmentally conscious consumers.

ADM recently performed an external survey of 5,000 respondents and found that 49% of adults fall into the “flexitarian” category, meaning they are actively seeking plant-based protein as a replacement for some, but not all, animal protein in their diets. Recent trends in pet products show that pet owners are looking for similar meat-free alternatives for their pets3.

On the other side of this alternative protein trend is insect-based proteins like Black Soldier Fly Larvae (BSFL). Not commonly found in human food products, this type of protein is actively being explored for pet food by pet brands. The insect farmers that supply this type of protein often promote their products as highly digestible and better for the planet, hitting on current consumer demand for high-quality nutrition and alternative ingredient sourcing.

Given the innovation and growth in this market, we anticipate an increasing number of pet food brands will promote the benefits of alternative proteins and other ingredients on their product packaging.

Sustainability in packaging materials

Finally, we move from nutrition and ingredients to the packaging itself as we are now seeing products enter the market with claims like “100% Recyclable Packaging”1. For pet food, the most common sustainable packaging types are those that decompose faster than plastic, reusable packaging that allows for refills, bio-based packaging made with fewer emissions, and packaging made only from recycled PET plastic (rPET).

Recent research shows that consumer demand for sustainability in pet products is high. When surveyed, 66% of pet owners are worried about climate change while non-pet owners were more than 6% less likely to state the same1.

While there are many variables that influence consumer buying habits, it appears that packaging is quickly becoming an important aspect of CPG manufacturing for pet brands. Innovation is likely to bring new packaging to market such as compostable materials and reusable packaging. This is an area where we expect to see significant growth and innovation in the coming years.

Wrapping up our packaging research

Packaging has long been a major driver in sales for CPG brands, and we expect label claims to continue catering to consumer trends. Humanization, premiumization, and the desire to reduce plastic waste is requiring pet brands to adapt their packaging or be left behind. Meanwhile, innovation in ingredients such as alternative proteins help to set products apart.

In this multi-billion-dollar industry, competition is fierce, and brands will continue to position their products in a way that connects with consumer demands. At ADM, we will continue to monitor these trends, so brands can keep their edge in a crowded market.

1Euromonitor Passport, World Market for Pet Care 2023

如有咨询、疑问或需了解详情,请联系我们。我们随时为您效劳。

Hi! We're Performing Maintenance.

ERROR CODE: 503

Here are some helpful links

Hello

Need some more information? Complete this contact form and you will be contacted in the next 5 business days.

本内容遵循内容发布之日适用的美国法律和法规。特别指出,客户必须确保其成品的任何标签和声明遵循销售此成品的国家/地区的监管要求和科学标准。并非所有产品都能在所有地区销售。